Limits to the GHG reduction potential of the IRA and BIL

Greenhouse gas (GHG) reduction in the United States is central to the globe-spanning effort to fight climate change. Not only because the US is the largest economy in the world, but because Americans are among the highest per-capita emitters on the planet (using trade-balanced CO2 accounting). So it was some relief to global society when climate action featured as a centerpiece of two major bills passed by the US Congress in 2021 and 2022. These were the Infrastructure Investment and Jobs Act, or Bipartisan Infrastructure Law (BIL), and the Inflation Reduction Act (IRA), which are highlighted at the top of the National Climate Task Force’s climate action initiatives. Additionally, the IRA is considered by expert climate policy analysts as “the single largest action ever taken by Congress and the US government to combat climate change.”

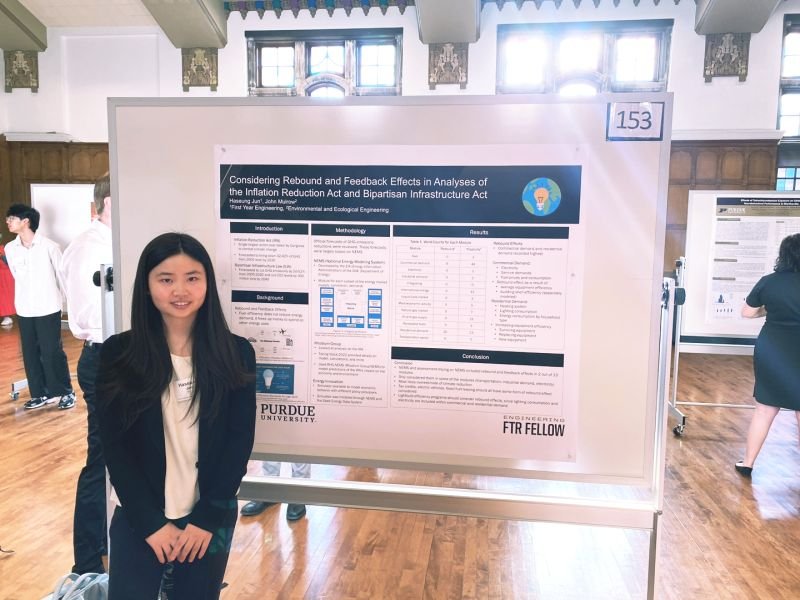

Of course, the political viability of these laws required that they fund initiatives meant to build new infrastructure, create jobs, and grow the economy. With rebound effects and global context in mind, the question arises whether the GHG reduction potential of the IRA and BIL may be compromised by the infrastructure and economic activities they support. This past semester, two first-year engineering students - Ingrid Owczarzak and Haseung Jun - investigated this question and presented their results at the Spring Undergraduate Research Conference.

Ingrid’s study “Explicit and Implicit Emissions Reductions Within US Laws” consisted of textual and budgetary analysis of both the BIL and IRA. She analyzed the descriptions of all climate, energy, and infrastructure programs under these laws and noted whether GHG emissions reduction was described as a program requirement (explicit), a potential program outcome (implicit), or not mentioned at all. A major finding is that emissions reduction is explicit in less than 10% of BIL programs and approximately 41% of IRA programs. These results point to the need to consider economic feedback effects in any holistic evaluation of the GHG reduction potential of these laws. Did expert emissions analysis of the IRA and BIL consider such effects? Haseung took on this question.

Haseung’s study “Considering Rebound and Feedback Effects in Analyses of the Inflation Reduction Act and Bipartisan Infrastructure Law” required her to dig into the methodology behind leading impact analyses of these policies. Her major finding was that professional climate policy analyses typically rely on modeling the US economy using NEMS, the National Energy Modeling System, maintained by Energy Information Administration. Haseung dug into the descriptions of each of the NEMS’ many economic sub-modules, to ask whether economic feedbacks such as rebound are modeled. She found that rebound effects are explicitly modeled in 2 of 13 modules (Residential Demand and Commercial Demand), and that most modules have some aspect of price elasticity (i.e. price feedback) modeling. While it is unsettling that most of the policy analyses we looked at did not mention rebound, a phenomenon that dampers most efficiency-based emissions reduction programs, we were not able to conclusively say that rebound was not considered in expert analyses of the IRA and BIL. A more in-depth critique of the NEMS is called for.

Congratulations to Ingrid and Haseung on a great semester and a solid launch into your environmental and research careers!

Hasueng Jun presents her poster at the Purdue Spring Undergraduate Research Conference, April 2023